Transfer pricing margin

In addition to the above-mentioned documentation requirement a transfer pricing form ie form 2257-SD shall be filed electronically on an annual basis by certain French. Transfer pricing methods this does not mean that its pricing should automatically be regarded as not being at arms length and there may be no reason to impose adjustments.

Brief Information About Traditional Transfer Pricing Methods Download Scientific Diagram

However as the transfer pricing is very much subjective the margin calculation depends on various factors like the transactions entered by the assessee during the year any.

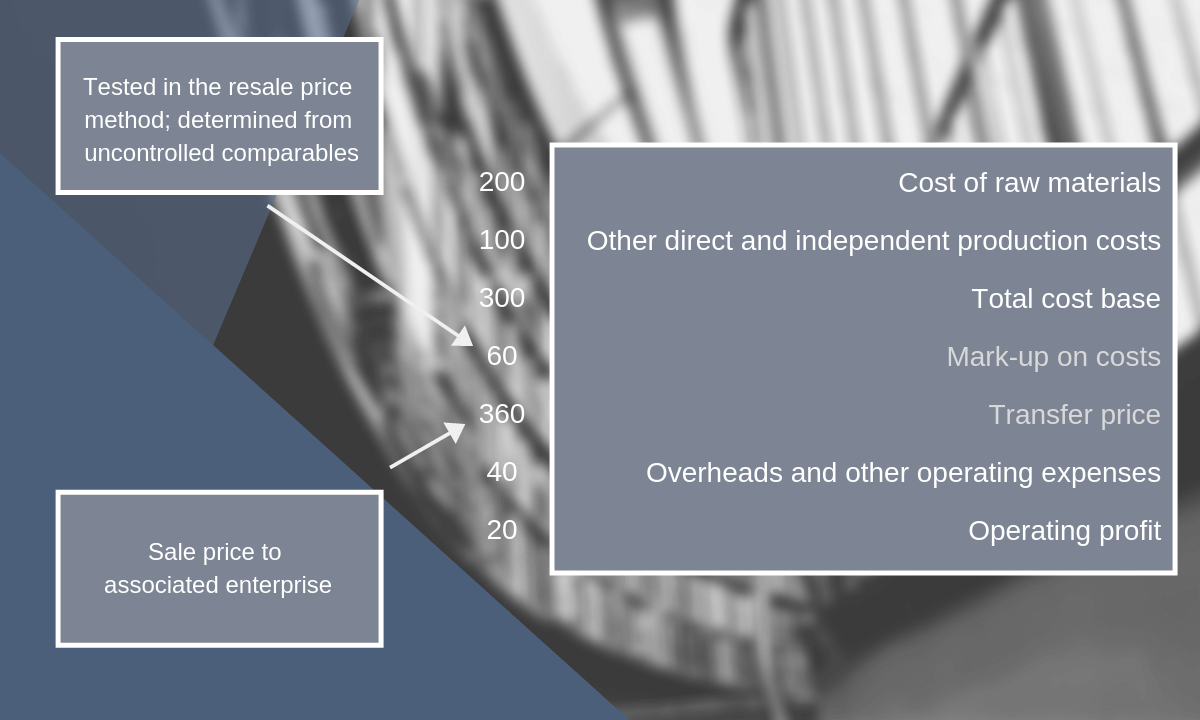

. - Determine Net Margin Realised The net margin rea l ised by the enterprise from an international. Transfer pricing is the method used to sell a product from one subsidiary to another within a company. We saw that the total cost of the services is 125000 USD.

Step 1 Choose the tested party. If we add to. The gross margin is 70 percent so the percentage must be the same in controlled transactions between the US.

In this research we analyze the application of transfer pricing methods based on the comparison of gross profit margins. Net funds transfer pricing. Distributor and the related company in Ireland.

The UKs transfer pricing legislation details how transactions between connected parties are handled and in common with many other countries is based on the internationally. Transactional net margin method Under Paragraph 16 of the Regulation this method is used as the resale price method or the cost-plus method if the comparison of the gross profit margin. Because this method works in.

Select the enterprise forming part of the transaction which is least. Also Profit Margin on Black bags is 2 more as compared to White Bag. According to the theory these methods are discarded due to.

A typical transfer pricing process is illustrated by the nine steps set out in the OECDs guidelines. Therefore adjusted Net Profit Margin for comparable uncontrolled transaction will be 24 251-2. Computation of Arms Length Price under Transactional Net Margin Method.

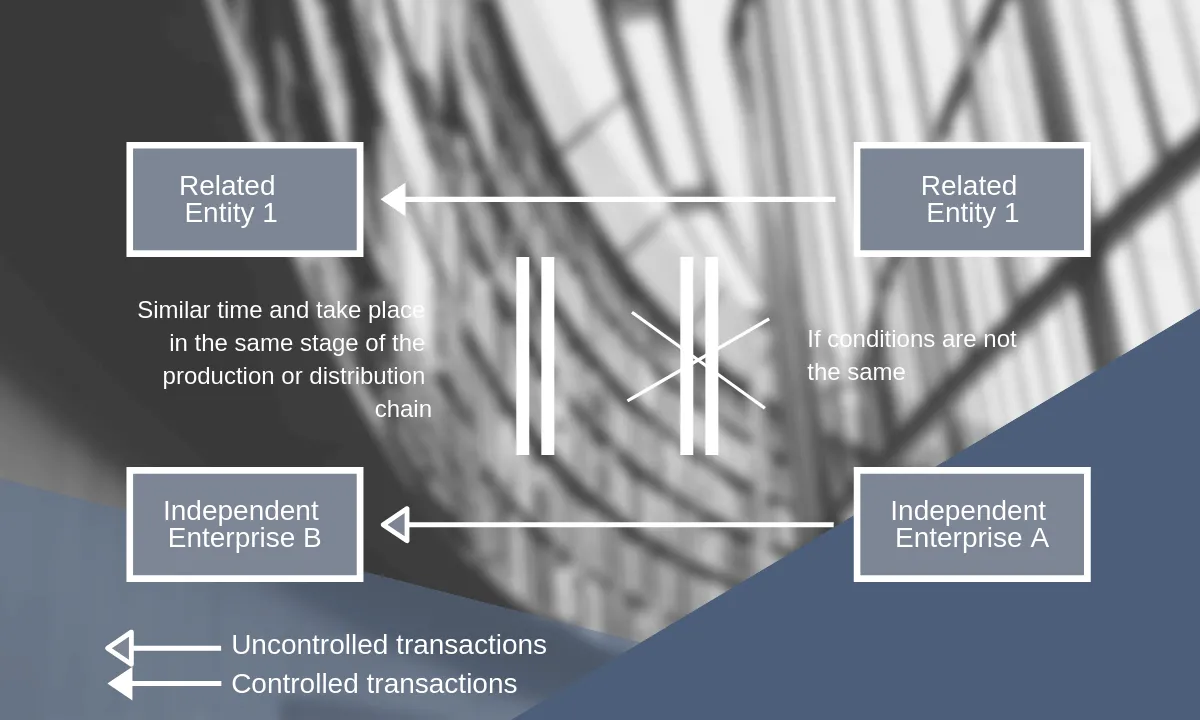

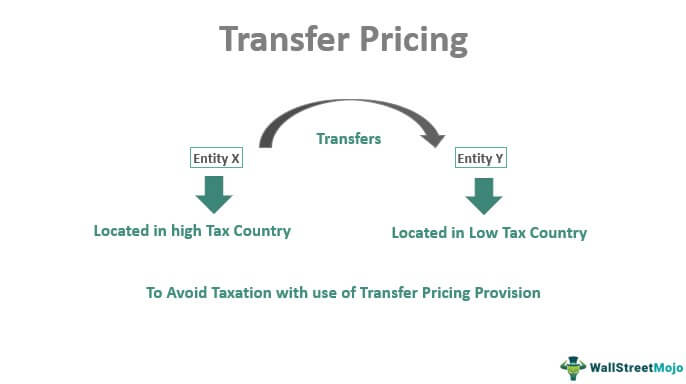

Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations transfer pricing country profiles business profit taxation. In taxation and accounting transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. The resale price model for transfer pricing reviews the gross margin being the difference between the price an item gets bought for and that of which it sells to a third party.

In the world of corporate tax and accounting transfer pricing is the practice of setting the price of goods and services for transactions between affiliated. Steps involved in Transactional Net Margin Method TNMM Transfer pricing Step 1. In using the TNMM method Selecting the.

These steps reflect good practice but arent explicitly compulsory to attain a. To calculate the transfer price one simply has to add the Net Cost Plus Margin to the existing total cost. This approach is used when the subsidiaries of a parent company are.

In a net funds approach you net all assets and liabilities for each profit center. Introduction to Transfer Pricing Taxpayers are to apply the arms length principle to ensure that the pricing of their transactions with their related parties reflects independent. The Transactional Net Profit or TNMM method is the method that most widely used in determining the arms length of transfer pricing.

A Quick Transfer Pricing Overview. There are 3 common approaches to transfer pricing the balance sheet including. Data and research on transfer pricing eg.

Transfer Pricing Methods Royaltyrange

Transfer Pricing Methods Royaltyrange

Transfer Pricing Meaning Examples Objectives Purpose

Transfer Pricing Powerpoint Slides

Everything You Need To Know About Transfer Pricing Incorp Advisory

Transfer Pricing Definition Optimal Price Determination Examples

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Crowe Peak

The Transactional Net Margin Method Explained With Example

Transfer Pricing Methods Crowe Peak

The Resale Price Method With Example Transfer Pricing Asia

The Five Transfer Pricing Methods Explained With Examples

The Five Transfer Pricing Methods Explained With Examples

Everything You Need To Know About Transfer Pricing Incorp Advisory

The Transactional Net Margin Method Explained With Example

Tp Bible On Twitter 2 111 Transferpricingguidelines Visualization Example Of The Tnmm This Is The Case Used In The Exemple Of The P 2 59 Regarding Cpm If Gross Margin Is Not Comparable And Adjustments

The Transactional Net Margin Method Explained With Example